20 skills for Chartered Accountant Resumes (with examples)

27 Jul 2023

Why are we writing this article?

Congratulations on becoming a Chartered Accountant! As you embark on your journey into the job market, you might be wondering how to make your mark and stand out among other candidates. With a myriad of skills and qualities expected from a Chartered Accountant, it can be overwhelming to pinpoint the ones that truly matter.

A career as a chartered accountant (CA) offers a dynamic environment, enabling you to engage with various businesses. As a CA, your role involves implementing accounting systems, preparing financial reports, and handling tax filings. To thrive in this profession, it's essential to be well-versed in key skills. In this article, we explore 20 crucial skills for a chartered accountant and how they contribute to their success in the workplace.

Having been in your shoes and navigated the competitive landscape, I understand the challenges you may face while preparing your resume. That's why I've written this article to provide you with valuable insights into the 20 most essential skills that employers seek in a Chartered Accountant.

From my years of experience in the industry, I've witnessed how having the right skills showcased in your resume can significantly increase your chances of landing your dream job. Whether you're a recent graduate or looking to switch roles, mastering these skills and presenting them effectively on your resume will help you shine bright in the eyes of potential employers.

In this comprehensive guide, I'll not only outline the key skills but also provide you with real-life examples to demonstrate how to articulate them on your resume. I want to equip you with the knowledge and confidence to craft an impressive resume that highlights your strengths as a Chartered Accountant.

So, let's dive in and uncover the skills that will make your resume truly exceptional, giving you the edge you need to succeed in your job search!

What will you learn in this article

In this article, you will discover the 20 indispensable skills that will elevate your Chartered Accountant resume to new heights. Each skill has been carefully selected based on its relevance and demand in the finance industry. By the end of this guide, you'll be equipped with the knowledge to create a compelling resume that impresses potential employers and increases your chances of landing your desired job.

When it comes to crafting a compelling resume, using the right language is crucial. Action verbs play a pivotal role in showcasing your achievements, skills, and potential to prospective employers. These dynamic words not only make your resume more engaging but also help hiring managers quickly grasp your impact and contributions in your previous roles. In this article, we will explore the power of action verbs and provide a comprehensive list of impactful words to help you create a standout resume that captures the attention of recruiters and elevates your professional narrative.

1. Knowledge of regulatory standards

Are you a recent Chartered Accountant eager to make a mark in the competitive job market? As you embark on your journey to kickstart a successful career in finance, auditing, or accounting, it's crucial to present yourself as a standout candidate. Crafting an exceptional resume is the first step in showcasing your expertise and potential to potential employers. In this comprehensive guide, we will explore the 20 essential skills that every Chartered Accountant should consider adding to their resume. From technical proficiencies to interpersonal abilities, these skills not only demonstrate your competency but also reflect your readiness to take on diverse challenges in the finance industry. Let's delve into each skill, complete with relevant examples, to empower you with the knowledge needed to create an impressive resume that sets you apart from the competition. Are you ready to elevate your career prospects and seize the opportunities that await you?

Ensuring Compliance and Accuracy:Chartered Accountants are entrusted with the responsibility of maintaining financial records and ensuring accuracy in financial reporting. Knowledge of regulatory standards, such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), enables them to navigate complex financial regulations and guidelines. This proficiency ensures that financial statements are prepared in compliance with the law, enhancing the credibility and reliability of the organization's financial information.

Mitigating Legal Risks:Chartered Accountants often play a vital role in tax planning and advising businesses on tax optimization strategies. Proficiency in regulatory standards empowers them to accurately calculate tax liabilities, claim eligible deductions, and ensure timely tax reporting. This skill contributes to the organization's financial health and maximizes tax efficiency, enhancing its overall competitiveness.

Advising on Taxation and Reporting:Chartered Accountants often play a vital role in tax planning and advising businesses on tax optimization strategies. Proficiency in regulatory standards empowers them to accurately calculate tax liabilities, claim eligible deductions, and ensure timely tax reporting. This skill contributes to the organization's financial health and maximizes tax efficiency, enhancing its overall competitiveness.

Elevating Auditing Abilities:For Chartered Accountants involved in auditing, a strong grasp of regulatory standards is imperative. It enables them to conduct thorough and reliable audits, identifying any financial irregularities or non-compliance issues. The ability to adhere to auditing standards strengthens the credibility of audit reports and instills confidence in stakeholders, including investors, creditors, and management.

Adapting to Global Practices:In an increasingly globalized business landscape, having knowledge of regulatory standards on an international level is invaluable. It allows Chartered Accountants to navigate cross-border transactions, comply with international reporting requirements, and support the organization's expansion into global markets. This global outlook enhances their versatility and opens doors to opportunities with multinational corporations and firms.

Adding "Knowledge of Regulatory Standards" to their resumes demonstrates a Chartered Accountant's dedication to excellence, ethical practices, and adherence to financial regulations. It positions them as trusted professionals capable of driving financial compliance and optimizing the organization's financial strategies. As the finance industry evolves, this skill will continue to be a key differentiator, making it an essential addition to any Chartered Accountant's resume.

2. Commercial awareness

Commercial awareness is a vital skill for Chartered Accountants to possess and highlight on their resumes. It refers to having a deep understanding of the broader business landscape, market trends, and industry dynamics. Chartered Accountants need to be more than just numbers experts; they should be able to comprehend how financial decisions impact the overall business strategy and bottom line.

Employers seek candidates who can demonstrate commercial awareness as it indicates a proactive and strategic mindset. By showcasing commercial awareness on their resumes, Chartered Accountants communicate their ability to contribute to the organization's success beyond accounting and financial tasks. They can analyze financial data in the context of the company's goals, identify growth opportunities, and make informed financial recommendations aligned with the company's overall vision.

Employers seek candidates who can demonstrate commercial awareness as it indicates a proactive and strategic mindset. By showcasing commercial awareness on their resumes, Chartered Accountants communicate their ability to contribute to the organization's success beyond accounting and financial tasks. They can analyze financial data in the context of the company's goals, identify growth opportunities, and make informed financial recommendations aligned with the company's overall vision.

3. Digital Skills

In today's technologically advanced world, digital skills have become increasingly important for professionals in all industries, including chartered accountancy. As the accounting landscape evolves with the integration of advanced technology, having strong digital skills has become a crucial asset for chartered accountants. Including digital skills on your resume demonstrates your adaptability and readiness to embrace modern accounting practices, enhancing your appeal to potential employers.

Chartered accountants with digital skills are better equipped to leverage accounting software and financial tools effectively, streamlining processes, and improving efficiency. Proficiency in using data analysis tools and spreadsheets enables accountants to make data-driven decisions and offer valuable insights to clients and organizations. Moreover, digital skills also encompass familiarity with cloud-based accounting systems, which facilitate secure data storage and accessibility from anywhere, fostering remote work capabilities.

By highlighting your digital skills on your resume, you show prospective employers that you can stay ahead of industry trends, enhance productivity, and provide innovative solutions in the dynamic world of accounting. In an increasingly technology-driven environment, digital skills are a valuable addition to your skill set and can set you apart as a forward-thinking and versatile chartered accountant.

4. Knowledge of financial reporting standards

For chartered accountants, possessing a strong understanding of financial reporting standards is non-negotiable. Financial reporting is a critical aspect of the accounting profession as it involves the preparation and presentation of financial statements in compliance with applicable standards and regulations. Including this skill on your resume showcases your ability to adhere to accounting principles and provide accurate and reliable financial information.

Chartered accountants with a deep knowledge of financial reporting standards are better equipped to ensure the accuracy and transparency of financial statements. This skill is essential for interpreting complex accounting principles and applying them to various financial transactions, enabling you to provide valuable insights and advice to organizations, clients, and stakeholders.

Moreover, demonstrating expertise in financial reporting standards reflects your commitment to maintaining ethical practices and upholding the integrity of financial information. As businesses increasingly focus on transparency and accountability, showcasing this skill on your resume reinforces your suitability for roles that involve financial analysis, auditing, and consulting.

Employers seek candidates who can effectively navigate the complexities of financial reporting, as this skill ensures compliance with regulatory requirements and enhances the credibility of financial data. By including your proficiency in financial reporting standards on your resume, you demonstrate your ability to provide trustworthy financial information, which is a highly valuable trait for any aspiring chartered accountant in the competitive job market.

5. Analytics and Business Intelligence skills

In today's data-driven business landscape, possessing strong skills in analytics and business intelligence is becoming increasingly crucial for chartered accountants. As businesses generate vast amounts of data, the ability to collect, analyze, and interpret this data has become a strategic advantage. Including this skill on your resume demonstrates your proficiency in harnessing data to drive informed decision-making and contribute to a company's overall growth and success.

Chartered accountants with analytics and business intelligence skills can play a pivotal role in identifying trends, patterns, and opportunities within financial data. By utilizing various analytical tools and techniques, you can uncover valuable insights that help businesses optimize their financial performance, reduce costs, and enhance efficiency.

Moreover, incorporating analytics and business intelligence on your resume signals your adaptability in an evolving professional landscape. As technology continues to transform the accounting field, employers seek candidates who can leverage data to gain a competitive edge. Your proficiency in this area showcases your ability to stay ahead of industry trends and provide innovative solutions.

As a chartered accountant, being well-versed in analytics and business intelligence also positions you as a valuable asset for strategic planning and risk management. By using data-driven insights, you can assist businesses in making informed decisions, mitigating potential risks, and identifying growth opportunities.

Additionally, your analytics and business intelligence skills can enhance your value in multidisciplinary teams. Collaborating with professionals from various backgrounds, you can contribute valuable financial insights that align with broader business goals.

Overall, showcasing your expertise in analytics and business intelligence on your resume highlights your capacity to transform financial data into actionable insights, making you an indispensable asset for organizations seeking data-driven accounting professionals.

6. Professionalism

Demonstrating high professional standards is a critical trait that chartered accountants should emphasize on their resumes. Employers value professionals who uphold ethical principles, maintain integrity, and adhere to the highest standards of conduct. Including this trait on your resume not only highlights your commitment to professionalism but also showcases your potential to represent the organization with credibility and trustworthiness.

Chartered accountants often handle sensitive financial information and play a significant role in decision-making processes. Employers seek candidates who can be relied upon to maintain confidentiality, accuracy, and precision in their work. By emphasizing high professional standards on your resume, you indicate your dedication to handling financial matters responsibly and ethically.

In the field of accounting, where accuracy is paramount, having a reputation for maintaining high professional standards can distinguish you from other candidates. Employers recognize that a commitment to accuracy and attention to detail is essential in preventing costly errors and ensuring compliance with regulatory requirements.

Moreover, professionals with high professional standards are more likely to inspire confidence among clients, colleagues, and stakeholders. Your resume serves as an opportunity to showcase your reputation for ethical conduct, which can lead to increased trust and stronger professional relationships.

Employers also value individuals who continuously seek professional development and actively engage in ongoing learning. Including high professional standards on your resume indicates your willingness to uphold best practices, stay current with industry trends, and enhance your skills and knowledge as a chartered accountant.

Furthermore, this trait is closely linked to effective communication and interpersonal skills. Employers seek candidates who can communicate complex financial information with clarity and professionalism. Emphasizing high professional standards on your resume demonstrates your ability to interact with clients and colleagues in a respectful and courteous manner.

In summary, highlighting high professional standards on your resume reflects your commitment to ethical conduct, accuracy, and continuous improvement. It signals to employers that you are a reliable and trustworthy chartered accountant who upholds the values of the profession, making you a valuable asset to any organization.

7. Knowledge of financial markets

Demonstrating a solid understanding of financial markets is a valuable trait that chartered accountants should highlight on their resumes. In today's dynamic business environment, financial markets play a crucial role in shaping economic conditions and influencing business decisions. As a chartered accountant, possessing knowledge of financial markets can significantly enhance your capabilities and make you an asset to employers for several reasons.

Firstly, financial markets encompass a wide range of investment vehicles, including stocks, bonds, commodities, and derivatives. Understanding how these markets function, their key drivers, and the factors that influence their performance is essential for providing comprehensive financial advice to clients or employers. By showcasing your knowledge of financial markets on your resume, you signal your ability to analyze market trends and make informed financial recommendations.

Secondly, financial markets are closely linked to corporate finance and accounting practices. As a chartered accountant, your role may involve financial planning, budgeting, and investment decisions for organizations. Proficiency in financial markets can help you assess investment opportunities, manage risks, and optimize financial strategies for businesses. Employers seeking chartered accountants with a strong grasp of financial markets recognize the potential for improved financial decision-making and enhanced performance.

Thirdly, staying informed about financial markets is crucial for regulatory compliance and risk management. Financial markets' volatility and interconnectedness can impact businesses and investment portfolios. Knowledgeable chartered accountants can provide insights on risk mitigation strategies, ensuring that clients or employers are well-prepared to navigate market fluctuations.

Moreover, employers often seek candidates who can contribute to investment advisory services or wealth management divisions. Demonstrating expertise in financial markets on your resume can position you as a candidate capable of assisting clients with their investment decisions, asset allocation, and wealth preservation goals.

Furthermore, in an increasingly globalized economy, understanding international financial markets is becoming more critical. As businesses expand internationally, chartered accountants who possess knowledge of global markets and foreign exchange can provide valuable insights into managing currency risk and international investments.

In summary, highlighting your knowledge of financial markets on your resume showcases your ability to provide comprehensive financial guidance, make informed investment decisions, and navigate complex financial landscapes. Employers value chartered accountants who possess a well-rounded understanding of financial markets, as it enhances their ability to drive strategic financial outcomes and contribute to the organization's success.

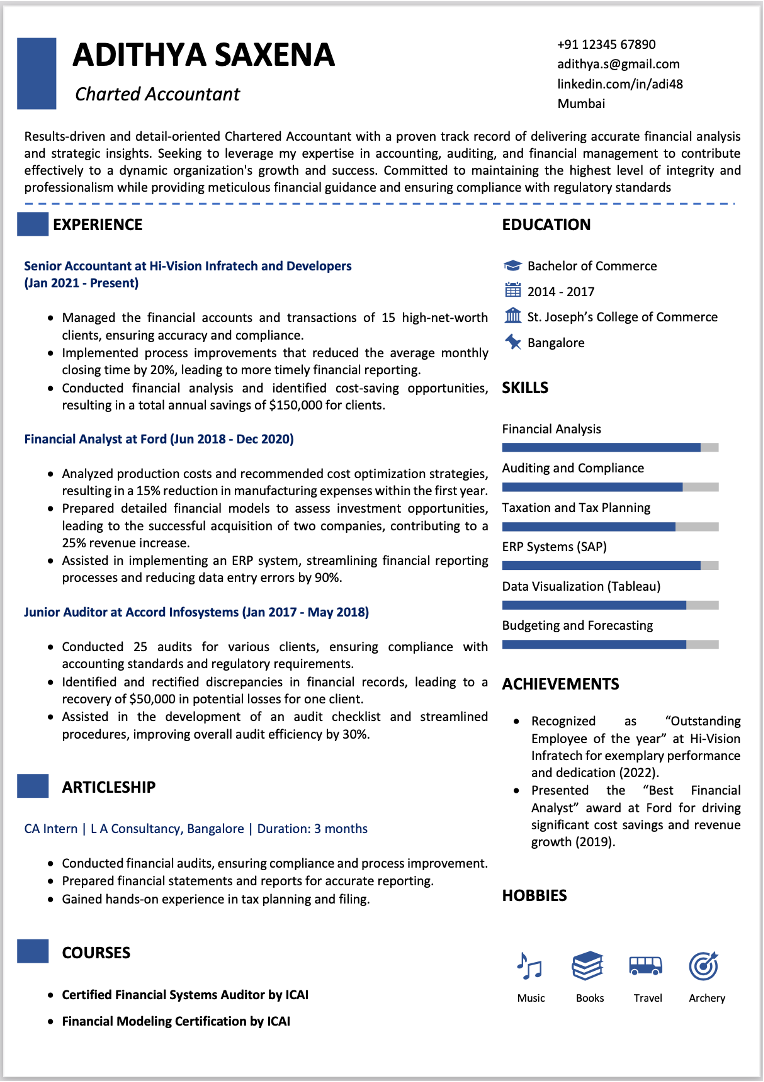

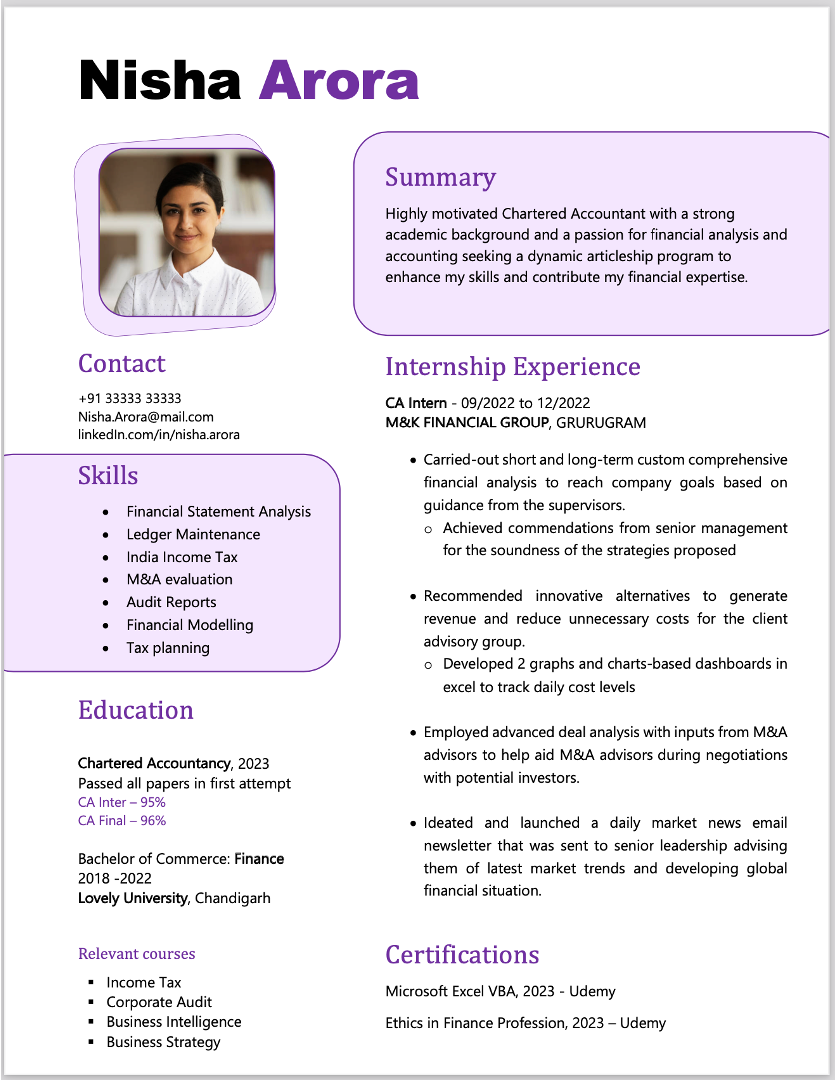

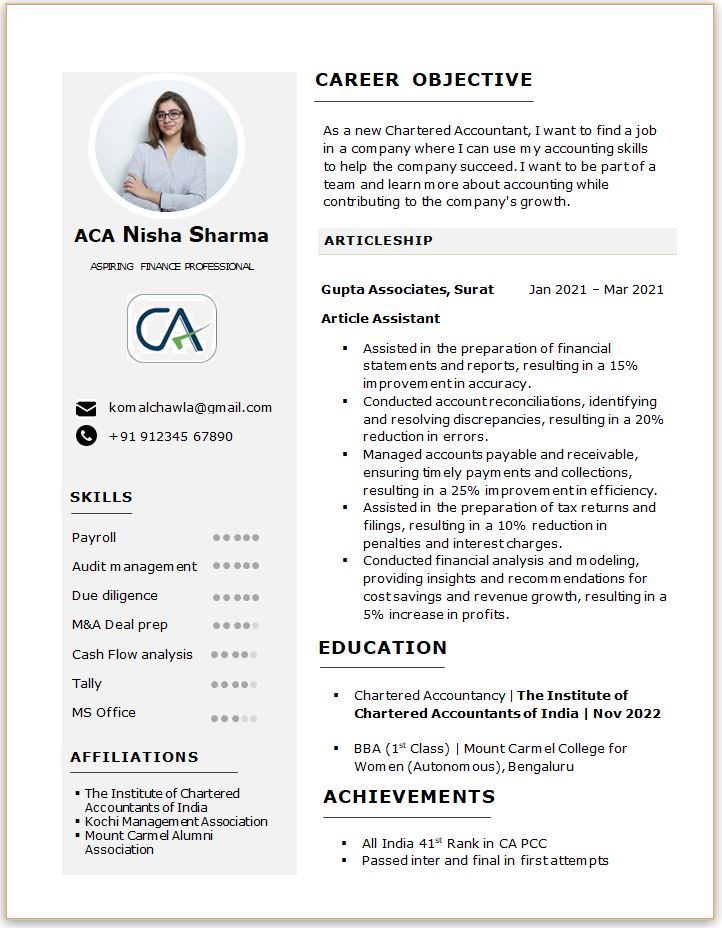

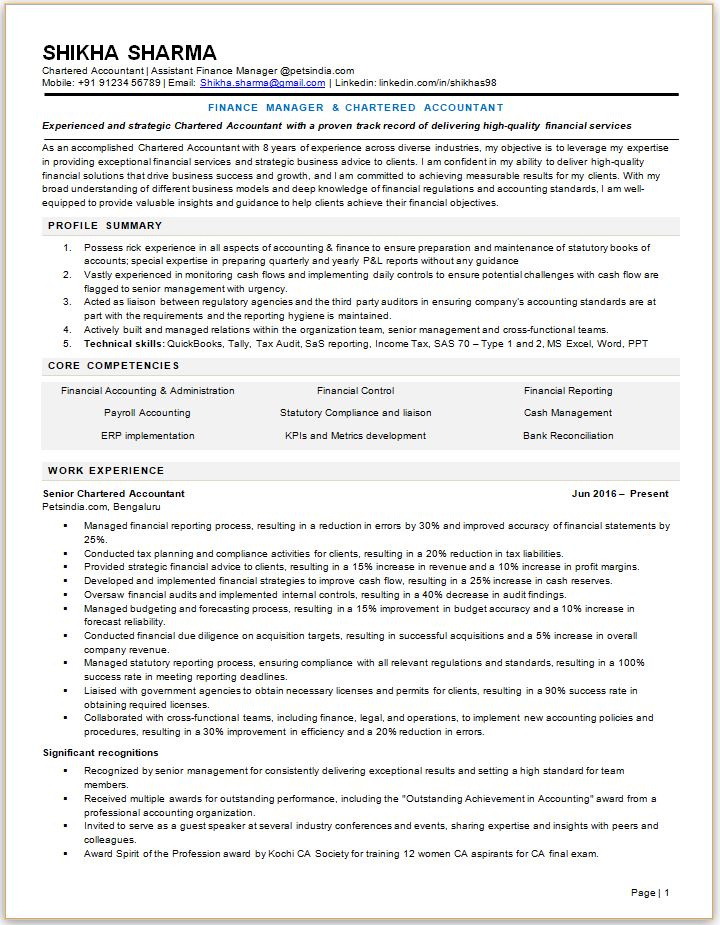

Charatered Accountant Resume Samples

Check out these resumes that are wonderful examples of how to list your skills, experiences, and hobbies and interests. These examples work both for experienced and recent CA graduates.

8. Communication Skills

Communication skills are a fundamental trait that chartered accountants should prioritize on their resumes. As finance professionals, chartered accountants often work in collaborative environments, where effective communication is vital for building strong relationships with clients, colleagues, and stakeholders. Here's why showcasing excellent communication skills can be a game-changer for chartered accountants seeking to enhance their employability:

Client Relations:Chartered accountants frequently interact with clients, addressing their financial concerns, offering strategic advice, and explaining complex financial concepts. Strong communication skills enable accountants to convey information clearly, ensuring clients fully comprehend their financial situations and the recommended strategies. The ability to articulate financial matters in a straightforward manner enhances client trust and satisfaction, fostering long-term relationships.

Team Collaboration:In accounting firms and corporate finance departments, teamwork is integral to success. Effective communication allows chartered accountants to collaborate seamlessly with colleagues, exchanging insights, coordinating tasks, and collectively working towards shared objectives. The capacity to express ideas concisely and actively listen to others fosters a productive and harmonious work environment.

Presentations and Reports:Chartered accountants often create financial reports and deliver presentations to clients and management. Strong communication skills empower accountants to structure their reports coherently, presenting data and analysis in a compelling manner. The ability to deliver engaging presentations demonstrates professionalism and instills confidence in the accuracy of financial information.

Conflict Resolution:In accounting roles, encountering disagreements or discrepancies may be inevitable. Effective communication skills allow chartered accountants to handle conflicts diplomatically, seeking constructive solutions and maintaining positive working relationships. Such skills are invaluable when dealing with diverse stakeholders with varying perspectives.

Regulatory Compliance:Chartered accountants must adhere to strict ethical standards and financial regulations. Communicating compliance requirements and advising clients or organizations on best practices necessitates clarity and precision. Effective communication ensures that all parties understand the importance of adhering to legal and ethical guidelines.

Client Acquisition and Business Development:For chartered accountants in private practice or looking to attract clients, strong communication skills are essential for networking and business development. Being able to articulate the value of services, build rapport with potential clients, and confidently present one's expertise can lead to a growing client base and business success.

Industry Reputation:Excellent communication skills contribute to an accountant's professional reputation. Clients and employers value accountants who can convey complex financial concepts with ease and professionalism. Positive word-of-mouth and recommendations from satisfied clients can lead to expanded opportunities in the job market.

communication skills are indispensable for chartered accountants in today's competitive job market. Employers seek professionals who can effectively communicate financial insights, collaborate with teams, and build strong client relationships. By emphasizing exceptional communication skills on their resumes, chartered accountants can demonstrate their ability to excel in various roles, contribute to organizational success, and serve as trusted financial advisors.

If you haven't read the article we wrote on "How to create your resume", we highlighly recommend that you read since it touches on all aspects of a resume in the moderen era.

9. Strategic thinking

Strategic thinking is a critical trait that chartered accountants should prominently highlight on their resumes. As financial professionals, chartered accountants are not just number crunchers; they play a strategic role in guiding businesses and clients towards financial success. Here's why showcasing strategic thinking is crucial for chartered accountants aiming to strengthen their resume:

Long-Term Financial Planning:Chartered accountants are instrumental in crafting long-term financial plans for businesses and individuals. Demonstrating strategic thinking on the resume indicates that the accountant can analyze complex financial data, anticipate future challenges, and devise proactive financial strategies to achieve sustainable growth and profitability.

Risk Assessment and Mitigation:A strategic chartered accountant can identify potential financial risks and vulnerabilities in an organization's operations. Employers value candidates who can conduct risk assessments and develop mitigation plans, ensuring businesses can navigate uncertainties and maintain financial stability.

Decision-making:Strategic thinking goes hand-in-hand with effective decision-making. Chartered accountants who can assess financial implications, weigh alternatives, and make informed decisions contribute significantly to their organization's success. Highlighting this trait on a resume signals that the accountant can provide valuable financial insights to support key decision-making processes.

Business Process Optimization:Employers seek accountants who can optimize financial processes and improve operational efficiency. A strategic-minded accountant can identify areas for process improvement, streamline financial workflows, and implement cost-saving measures to enhance the overall financial health of an organization.

Value-added Services:Strategic thinking enables chartered accountants to offer value-added services beyond traditional accounting tasks. This may include providing financial forecasting, recommending investment opportunities, and suggesting tax-saving strategies. Demonstrating strategic acumen on the resume conveys the ability to be a trusted financial advisor to clients or employers.

Alignment with Organizational Goals:Employers look for accountants who can align financial objectives with broader organizational goals. Strategic thinkers can tie financial performance to overall business objectives, contributing to the company's growth and success.

Adaptability and Innovation:Strategic-minded accountants are adaptable to changing market dynamics and can innovate financial approaches to meet evolving business needs. This trait is highly valued in dynamic industries, where staying ahead of the competition requires creative financial solutions.

Client Engagement:Strategic thinking enhances client engagement and satisfaction. Accountants who can identify clients' unique financial needs and tailor strategic plans accordingly build stronger, long-lasting client relationships.

Industry Recognition:Chartered accountants with strategic thinking capabilities are often recognized for their ability to provide forward-looking financial guidance. Such recognition can lead to increased opportunities for career advancement and leadership roles.

Strategic thinking is a valuable trait that sets chartered accountants apart in the competitive job market. Employers seek professionals who can go beyond basic accounting functions and provide strategic financial guidance to drive organizational success. By emphasizing strategic thinking on their resumes, chartered accountants can showcase their ability to navigate complex financial landscapes, contribute to business growth, and add substantial value to their clients or employers.

20 most important skills on Chartered Accountant Resumes

| # | Skill |

|---|---|

| 1 | Knowledge of regulatory standards |

| 2 | Commercial Awareness |

| 3 | Digital Skills |

| 4 | Knowledge of financial reporting standards |

| 5 | Analytics and Business Intelligence skills |

| 6 | Professionalism |

| 7 | Knowledge of financial markets |

| 8 | Communication Skills |

| 9 | Strategic thinking |

| 10 | Service Orientation |

| 11 | Knowledge of local laws and regulations |

| 12 | Problem Solving |

| 13 | Analytical orientation |

| 14 | Team work |

| 15 | Escalation |

| 16 | Management Information Systems & Reporting |

| 17 | Accounting Software Applications |

| 18 | Financial Risk Modelling |

| 19 | Fintech |

| 20 | Consulting |

10. Service orientation

Service orientation is a crucial trait that chartered accountants should highlight on their resumes to demonstrate their commitment to delivering exceptional client service and adding value to their organizations. Here's why showcasing service orientation is essential for chartered accountants seeking to strengthen their resume:

Client-Centric ApproachChartered accountants often work with a diverse clientele, including businesses and individuals. Employers value accountants who prioritize client satisfaction and can build strong, trust-based relationships. Demonstrating service orientation on the resume indicates that the accountant is dedicated to understanding and meeting clients' unique financial needs.

Responsiveness and Reliability:Service-oriented accountants are responsive to client inquiries, deadlines, and concerns. Employers seek professionals who can meet deliverables promptly, communicate effectively with clients, and provide reliable financial advice. A resume highlighting service orientation showcases the accountant's commitment to being a dependable and trusted financial partner.

Proactive Problem-Solving:Service-oriented accountants take a proactive approach to address clients' financial challenges. They actively seek opportunities to enhance financial performance, recommend tax-saving strategies, and offer solutions to improve overall financial health. Emphasizing this trait on the resume indicates the accountant's ability to add value beyond routine tasks.

Exceptional Communication:Effective communication is vital in the accounting profession, especially when conveying complex financial information to clients. Accountants with service orientation excel in explaining financial concepts in a clear and understandable manner, ensuring clients are well-informed and confident in their financial decisions.

Personalized Financial Solutions:Employers value accountants who can tailor financial solutions to meet individual client goals. A service-oriented approach means understanding clients' specific financial objectives and customizing strategies accordingly, showcasing the accountant's ability to deliver personalized financial services.

Empathy and Understanding:Service-oriented accountants display empathy towards clients' financial concerns and show understanding of their unique circumstances. This trait enables the accountant to provide compassionate support during challenging financial situations, fostering long-term client loyalty.

Team Collaboration:In a professional setting, service-oriented accountants collaborate effectively with colleagues and team members to ensure seamless service delivery. Employers seek candidates who can work collaboratively to address clients' needs comprehensively, creating a positive and cohesive work environment.

Focus on Continuous Improvement:Service orientation goes hand in hand with a commitment to continuous improvement. Accountants with this trait actively seek feedback, invest in professional development, and stay updated with industry trends, ensuring they offer the most relevant and valuable financial services.

Building Brand Reputation:Service-oriented accountants contribute to building a strong brand reputation for their organizations. Positive client experiences lead to word-of-mouth referrals and a positive brand image, positioning the organization as a trusted financial service provider.

Long-Term Client Retention:A service-oriented approach leads to long-term client retention and repeat business. Accountants who prioritize client satisfaction are more likely to retain clients and attract new ones through referrals, enhancing the organization's growth and success.

Service orientation is a critical trait for chartered accountants aiming to enhance their resume. Employers seek professionals who prioritize client needs, demonstrate exceptional communication skills, and provide personalized financial solutions. By showcasing service orientation on their resumes, chartered accountants can signal their dedication to client service excellence and their ability to be valuable assets to their organizations.

11. Knowledge of local laws and regulations

Listing a comprehensive understanding of local laws and regulations as a skill on their resume is paramount for chartered accountants, as it can significantly enhance their professional profile. Here's why this skill is of paramount importance and should be emphasized on a chartered accountant's resume:

Legal Compliance:Chartered accountants bear the responsibility of ensuring that their clients or organizations adhere to relevant local laws and regulations. Demonstrating proficiency in this area conveys to potential employers that the accountant can navigate complex legal frameworks and uphold ethical standards.

Risk Mitigation:Being well-versed in local laws empowers chartered accountants to identify and address potential compliance risks. Employers seek accountants who can mitigate financial and legal hazards, safeguarding the organization's reputation and financial stability.

Accurate Financial Reporting:Knowledge of local financial regulations enables chartered accountants to prepare accurate and transparent financial reports. This skill is particularly valuable when dealing with audits and financial statements, as adherence to legal requirements ensures the reliability and integrity of financial information.

Tax Planning and Optimization:Understanding local tax laws allows chartered accountants to provide strategic tax planning advice to their clients or organizations. This proficiency can help minimize tax liabilities while remaining fully compliant with tax regulations.

Client Trust and Confidence:Demonstrating a strong grasp of local laws and regulations instills trust and confidence in clients or employers. Accountants who possess this skill are perceived as reliable professionals capable of navigating intricate legal matters.

In conclusion, including "Knowledge of Local Laws and Regulations" as a prominent skill on a chartered accountant's resume showcases their ability to uphold legal compliance, mitigate risks, ensure accurate financial reporting, provide effective tax planning, and ultimately serve as a trusted financial advisor to their clients or employers./p>

12. Problem solving

Problem-solving is like a superhero cape for chartered accountants, and it's definitely a must-have on their resume! Here's why it's such a big deal and why they should flaunt it:

Numbers Can Be Tricky:Crunching numbers and handling financial data isn't always a walk in the park. Chartered accountants need strong problem-solving skills to dissect complex financial challenges, identify discrepancies, and find innovative solutions.

Navigating Audits:When auditors come knocking, it's time to put on the problem-solving hat. Chartered accountants must unravel financial puzzles, address compliance issues, and ensure everything is spick and span for a successful audit.

Crunch Time Cruncher:In the finance world, time is money, and pressure can run high. Having top-notch problem-solving abilities helps accountants stay cool under pressure, tackle deadlines, and find quick solutions without breaking a sweat.

Financial Detective Work:Sometimes, the financial trail leads to mystery corners. Chartered accountants must channel their inner Sherlock Holmes to dig deep, analyze data, and uncover hidden insights to support strategic decision-making.

Client Superheroes:Clients rely on chartered accountants to guide them through financial complexities. Strong problem-solving skills enable accountants to understand client needs, troubleshoot financial challenges, and provide tailored solutions.

Growth Catalysts:Companies crave accountants who can help them grow. Problem-solving prowess allows chartered accountants to optimize financial processes, identify growth opportunities, and propel businesses toward success.

Crisis Averters:When financial storms loom, it's the problem-solving skills that save the day. Accountants adept at navigating crises, offering risk management strategies, and steering the ship back on course are highly sought-after.

Innovative Wizards:Embracing new technologies and financial tools is the way to go. Accountants with strong problem-solving abilities can adapt to changes, leverage tech advancements, and lead the way in a dynamic financial landscape.

In a nutshell, problem-solving is like the secret sauce that makes chartered accountants stand out. It's the art of financial detective work, crisis averters, and growth catalysts – all rolled into one impressive skillset. So, on their resume, chartered accountants should wave that problem-solving flag high, and let their future employers know they're ready to take on any financial challenge that comes their way!

Time management

Time management is a fundamental skill that is common across functions. So you should definitely include thawt on your resume. Here's why it's imperative to include it on CA resumes:

Deadline Adherence:As a Chartered Accountant, you'll encounter a multitude of critical deadlines, ranging from financial reports to tax filings and audits. Demonstrating exceptional time management abilities will empower you to handle these tasks efficiently, ensuring timely delivery of results without compromise.

Multitasking Mastery:The finance industry demands proficiency in managing multiple financial projects and responsibilities concurrently. By showcasing your strong time management skills, you'll excel in prioritizing tasks effectively, preventing any essential aspects from being overlooked.

Stress Mitigation:In the fast-paced and high-pressure finance sector, your adeptness in time management will enable you to stay composed under challenging circumstances. It will equip you to manage tight schedules and handle stressful situations with poise.

Streamlined Workflow:Effective time management contributes to a seamless workflow. By organizing your schedule thoughtfully, you'll optimize processes, enhance overall productivity, and foster success within your team or organization.

Precision and Accuracy:Rushing through tasks can lead to errors, which is unacceptable in the finance field where precision is paramount. Your time management prowess will allow you ample time for comprehensive reviews, ensuring minimal mistakes and maintaining exceptional quality.

Professional Credibility:Employers highly value candidates with strong time management abilities, as it reflects a sense of professionalism and dedication to one's craft. By highlighting this skill, you'll portray yourself as a reliable and trustworthy asset to any prospective employer.

Catalyst for Career Advancement:Effective time management lays the foundation for career growth. As you efficiently handle tasks, take on additional responsibilities, and consistently deliver outstanding results, you'll open doors to promotions and exciting professional opportunities.

Work-Life Balance:Striking a work-life balance is crucial for sustained success and well-being. Proficient time management will enable you to allocate time for personal interests, rejuvenate, and maintain a healthy lifestyle, contributing to your overall effectiveness.

Emphasizing your exceptional time management skills on your resume will undoubtedly underscore your competence as a disciplined and organized Chartered Accountant, poised to excel in the dynamic world of finance. Your adeptness in managing time efficiently will demonstrate your readiness to meet challenges head-on and contribute significantly to any organization you become part of.

13. Analytical orientation

Analytical thinking is a vital skill for Chartered Accountants, and including it on your resume can significantly enhance your candidacy. As a Chartered Accountant, you will encounter complex financial data, regulatory requirements, and business challenges. Demonstrating strong analytical thinking abilities showcases your capacity to methodically analyze financial information, identify patterns, and draw meaningful insights. This skill enables you to make informed decisions, devise strategic financial plans, and provide valuable recommendations to clients and organizations. Employers highly value candidates who can apply critical thinking to solve problems, identify opportunities, and optimize financial processes. By highlighting analytical thinking on your resume, you demonstrate your proficiency in handling intricate financial scenarios, a trait that sets you apart as a competent and reliable Chartered Accountant.

14. Team work

Teamwork is an indispensable skill that Chartered Accountants should highlight on their resumes. As a Chartered Accountant, you won't work in isolation; instead, you'll collaborate with diverse teams comprising finance professionals, auditors, consultants, and other stakeholders. Demonstrating strong teamwork abilities on your resume conveys your capacity to work harmoniously within these teams, fostering open communication and cooperation. Effective teamwork ensures smooth financial operations, seamless audits, and successful project completions. It also reflects your adaptability, interpersonal skills, and willingness to contribute to collective goals. Employers highly value candidates who can collaborate effectively, as it leads to enhanced efficiency, innovative problem-solving, and overall organizational success. By emphasizing teamwork on your resume, you present yourself as a well-rounded professional who can thrive in a collaborative work environment, an asset that will undoubtedly catch the eye of potential employers.

15. Escalation

Escalation is a crucial skill that Chartered Accountants should include in their resumes. As a Chartered Accountant, you may encounter complex financial or auditing challenges that require timely resolution. Demonstrating your ability to escalate issues effectively showcases your proactiveness in handling critical situations. By promptly escalating pertinent matters to the appropriate authorities or management, you can prevent potential financial risks, ensure compliance with regulations, and maintain the integrity of financial reporting. Including escalation on your resume reflects your accountability and commitment to upholding ethical standards. Employers value candidates who can identify and address potential issues before they escalate into major problems, as it demonstrates your dedication to safeguarding the financial interests of the organization. With this skill highlighted on your resume, you position yourself as a responsible and reliable professional, capable of making informed decisions and taking appropriate actions to navigate complex financial scenarios.

16. Management Information Systems & Reporting

Management Information Systems (MIS) and reporting is a critical skill that Chartered Accountants should emphasize on their resumes. In today's data-driven business environment, organizations heavily rely on accurate and timely information to make strategic decisions. As a Chartered Accountant, your proficiency in MIS and reporting is invaluable, as it enables you to collect, analyze, and interpret financial data effectively.

Including MIS and reporting on your resume demonstrates your ability to leverage technology and accounting software to generate insightful reports that aid in informed decision-making. You can showcase your expertise in creating financial statements, budget reports, cash flow analyses, and other essential financial reports that provide valuable insights for stakeholders and management.

Moreover, your skill in streamlining and automating financial reporting processes can significantly improve efficiency and reduce manual errors, making you an asset to any finance or accounting team. Employers seek candidates who can transform raw data into meaningful information and present it in a clear, concise manner. By highlighting your proficiency in MIS and reporting, you position yourself as a forward-thinking and tech-savvy professional, capable of optimizing financial processes and contributing to the organization's overall success.

17. Accounting Software Applications

Knowledge of accounting software applications is a highly valuable skill that Chartered Accountants should prominently feature on their resumes. In today's fast-paced business world, accounting software plays a pivotal role in streamlining financial processes and enhancing efficiency. By showcasing your expertise in accounting software, you demonstrate your ability to adapt to modern financial practices and effectively manage financial data.

Employers seek Chartered Accountants who are proficient in using popular accounting software applications such as QuickBooks, Xero, SAP, or Oracle Financials, among others. Your proficiency in these tools allows you to efficiently handle tasks like bookkeeping, financial analysis, payroll management, and tax reporting. Additionally, you can create detailed financial reports and perform data analysis with ease, providing essential insights for decision-making.

Including knowledge of accounting software on your resume showcases your commitment to staying up-to-date with industry trends and technology advancements. Employers appreciate candidates who can seamlessly integrate technology into their work processes, as it leads to increased accuracy and better financial management.

Having this skill on your resume positions you as a versatile and adaptable Chartered Accountant, capable of leveraging technology to optimize financial operations. It demonstrates your readiness to tackle complex financial challenges and contribute to the organization's financial success. As businesses increasingly rely on technology-driven solutions, your proficiency in accounting software applications becomes a significant differentiator, making you a sought-after candidate in the job market.

18. Financial Risk Modelling

In the ever-evolving financial landscape, businesses face various risks that can significantly impact their financial performance and stability. By showcasing expertise in financial risk modeling, you demonstrate your ability to assess, analyze, and mitigate these risks, making you an invaluable asset to any organization.

As a Chartered Accountant, having proficiency in financial risk modeling allows you to identify potential threats and uncertainties that could affect an organization's financial health. You can employ statistical techniques, scenario analysis, and predictive modeling to assess the impact of various risk factors, such as market volatility, interest rate fluctuations, credit risk, and operational risks.

By using financial risk modeling tools and methodologies, you can quantify risks and provide valuable insights to support decision-making at both strategic and tactical levels. Your ability to develop risk models empowers you to develop risk mitigation strategies and optimize risk-reward trade-offs, contributing to improved financial performance and enhanced stakeholder confidence.

Employers seek Chartered Accountants with financial risk modeling skills because it enhances an organization's ability to proactively address potential challenges and capitalize on opportunities. Your expertise in risk modeling demonstrates your forward-thinking mindset and capacity to navigate uncertain economic conditions, ensuring financial sustainability.

Additionally, with the growing importance of risk management and compliance, financial institutions and corporations value Chartered Accountants who can assess risk exposures and adhere to regulatory requirements. By showcasing financial risk modeling on your resume, you position yourself as a competent and reliable professional capable of safeguarding an organization's financial well-being and ensuring its long-term success.

19. Fintech

Knowledge of fintech is an increasingly vital skill that Chartered Accountants should emphasize on their resumes. Fintech, short for financial technology, refers to the innovative use of technology to deliver financial services and products. As the financial industry rapidly adopts digital transformation, having a solid understanding of fintech can set you apart as a forward-thinking professional.

Incorporating fintech on your resume showcases your adaptability and readiness to embrace emerging trends in the financial sector. With the rise of digital payment systems, blockchain technology, robo-advisors, and AI-driven financial analytics, companies are seeking Chartered Accountants who can navigate the intersection of finance and technology.

Having knowledge of fintech equips you to streamline financial processes, automate tasks, and enhance data analysis, resulting in improved efficiency and accuracy. As businesses seek innovative solutions to optimize financial operations, your fintech expertise positions you as a valuable asset for driving growth and staying ahead of the competition.

Fintech proficiency enables you to leverage cutting-edge tools and platforms for financial modeling, risk management, and real-time reporting. By integrating fintech solutions, you contribute to faster decision-making and agile financial strategies, critical attributes in today's fast-paced business environment.

Moreover, fintech knowledge empowers Chartered Accountants to participate in digital transformation initiatives, making them more versatile across various sectors and industries. You can contribute to the implementation of online payment systems, e-commerce platforms, and digital banking services, fostering a customer-centric approach and enhancing user experiences.

As the financial landscape evolves, regulatory bodies are also adapting to the changing landscape. By having a grasp of fintech's regulatory implications, you demonstrate your ability to ensure compliance with evolving laws and guidelines, which is essential for maintaining trust and credibility in the financial sector.

In summary, showcasing knowledge of fintech on your resume highlights your adaptability, technological acumen, and commitment to staying at the forefront of the finance industry's digital revolution. As companies seek to stay competitive and embrace innovation, having fintech expertise positions you as a valuable candidate for contributing to their growth and success in an increasingly technology-driven world.

20. Consulting

Consulting is a highly valuable skill that Chartered Accountants should definitely include on their resumes. As a Chartered Accountant, possessing strong consulting abilities sets you apart as a strategic thinker and problem solver, making you an asset in any financial organization.

Including consulting on your resume showcases your capability to provide expert financial advice and guidance to clients, colleagues, and stakeholders. With your in-depth knowledge of accounting principles and regulations, you can offer valuable insights and recommendations to help businesses make informed financial decisions.

As a consultant, you are equipped to identify areas for improvement, cost-saving opportunities, and risk mitigation strategies, ensuring financial stability and growth for your clients or employer. This skill demonstrates your proactive approach to financial management, reflecting your commitment to delivering value-added services.

Moreover, consulting proficiency enables you to excel in roles where collaboration and effective communication are crucial. As a Chartered Accountant, you'll often work with cross-functional teams, such as auditors, finance professionals, and executives. Your consulting skills allow you to foster positive working relationships and deliver complex financial information in a clear and concise manner.

In addition to providing advice, consultants must excel in analyzing financial data and developing innovative solutions to meet specific business needs. Your ability to use financial data to identify trends, make forecasts, and design strategic plans adds significant value to the organization and enhances decision-making processes.

Chartered Accountants with consulting expertise also excel in client-facing roles, allowing them to build strong rapport with clients and provide personalized financial solutions. Understanding your clients' unique challenges and tailoring your services to meet their requirements creates a positive impact on client satisfaction and retention.

Furthermore, consulting aptitude enhances your problem-solving capabilities, allowing you to tackle complex financial challenges and recommend feasible solutions. Employers seek Chartered Accountants who can think critically and apply their financial acumen to overcome business obstacles, ensuring the organization's success and growth.

Lastly, consulting skills are transferable across various industries and sectors. This versatility allows Chartered Accountants to explore diverse career opportunities, such as financial advisory, management consulting, or even setting up their own consulting practices. Your consulting prowess opens doors to exciting career paths beyond traditional accounting roles.

In summary, adding consulting as a skill on your resume demonstrates your ability to provide expert financial guidance, analyze data, and deliver strategic solutions. This skillset enhances your professional versatility, making you a sought-after candidate in the job market. As organizations strive for financial excellence and seek out innovative solutions, your consulting expertise positions you as a valuable asset for driving success and growth in any financial capacity.

Ever wondered how to include hobbies and interests on your resume?

Including hobbies and interests on your resume can help you stand out from the competition and provide valuable insights into your personality, skills, and potential cultural fit within a company.

50 Hobbies and Interests for Resume

There is a special article we wrote on how to include hobbies and interests on resume for everyone. We highlighly recommend that you read since it has about 100 examples of hobbies and intersts.

Did you enjoy this article? Then these below might also be of interest to you

1. Resume writing demystified - One of our most popular articles that goes throug a lot of misconceptions and clarifies them.

2. Resume format for freshers - If you are a recent college graduate, you would enjoy reading this article as it would provide you with information specific to preaparing your first resume.

3. 50 Hobbies and Interests to put on your resume - If you wondered what hobbies and interests you should put on your resume, this article can help you become more strategic about this fun topic.