Modern Resume

MBA Finance Template Resume

MBA Resume Template

mbafinan

Objective

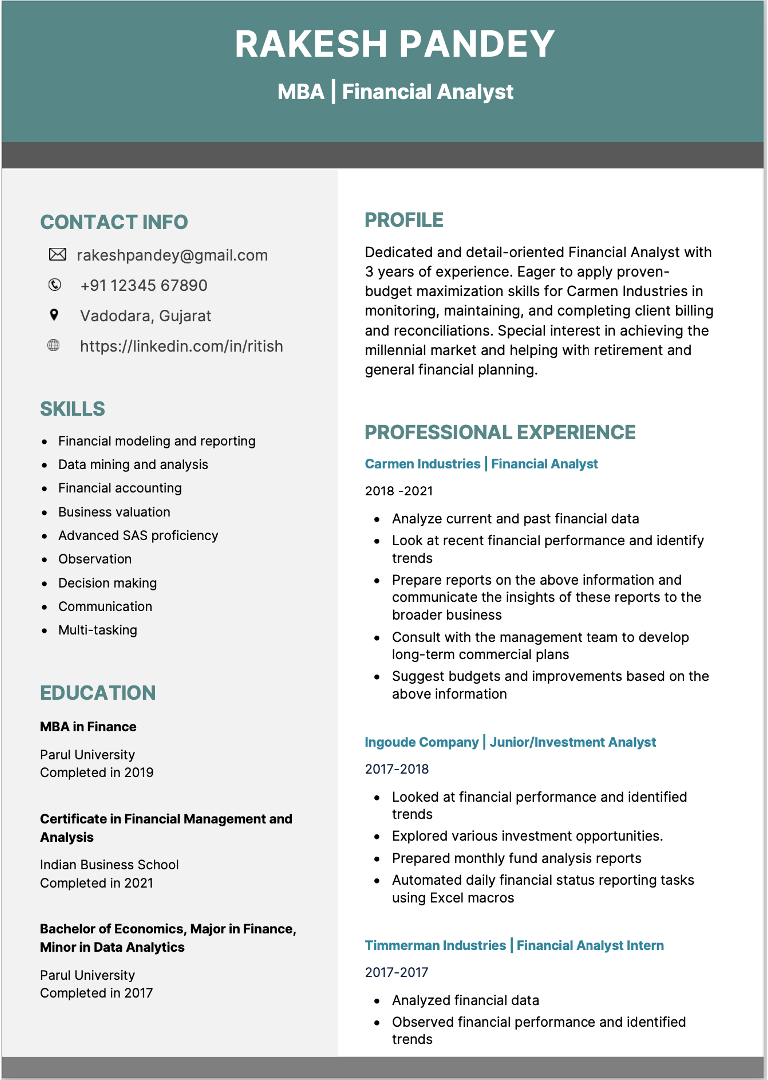

Dedicated and detail-oriented Financial Analyst with 3 years of experience. Eager to apply proven-budget maximization skills for Carmen Industries in monitoring, maintaining, and completing client billing and reconciliations. Special interest in achieving the millennial market and helping with retirement and general financial planning.

Education

MBA in Finance

Parul University

Completed in 2019

Certificate in Financial Management and Analysis

Indian Business School

Completed in 2021

Bachelor of Economics, Major in Finance, Minor in Data Analytics

Parul University

Completed in 2017

Skills

• Financial modeling and reporting • Data mining and analysis • Financial accounting • Business valuation • Advanced SAS proficiency • Observation • Decision making • Communication • Multi-tasking

Interests/Hobbies

Including relevant hobbies on a resume can provide insights into an individual's personality, interests, and potentially transferable skills.

For an aspiring finance professional, it's essential to choose hobbies that demonstrate qualities such as teamwork, analytical thinking, leadership, and attention to detail.

Here are 10 relevant hobbies for a finance professional's resume:

Investing and Stock Analysis: Demonstrates a genuine interest in finance and investments. Mentioning hobbies related to analyzing stocks, tracking market trends, or managing a personal investment portfolio can showcase your passion for the field.

Financial Blogging or Writing: If you enjoy writing about financial topics or have a personal finance blog, it reflects strong communication skills and the ability to simplify complex financial concepts—an important skill for finance professionals.

Data Analysis and Programming: Hobbies such as coding, data analysis, or programming in languages like Python or R can highlight quantitative and analytical skills. Proficiency in data-related hobbies can be valuable in financial roles.

Participation in Finance Competitions: Involvement in finance-related competitions, such as case competitions, investment challenges, or financial modeling contests, demonstrates a commitment to continuous learning and the application of financial concepts.

Leadership in Financial Clubs or Societies: Mentioning leadership roles or active participation in finance-related clubs, student organizations, or societies at school or in the community underscores your leadership and teamwork abilities.

Financial Literacy Advocacy: If you are involved in initiatives or organizations that promote financial literacy, it shows a commitment to educating others about financial concepts and responsibilities.

Language Skills, Especially in Finance Contexts: If you are fluent in a language commonly used in international finance (e.g., Mandarin, Spanish), or if you've taken language courses specific to finance, it can be an asset, especially in global finance roles.

Networking and Industry Events: Attending finance conferences, seminars, or industry networking events demonstrates your commitment to staying updated on industry trends and expanding your professional network.

Excel Modeling and Spreadsheet Enthusiast: If you enjoy creating complex financial models, optimizing spreadsheets, or have a knack for using advanced features in Excel, it highlights your technical skills, crucial in many finance roles.

Mentoring or Tutoring in Finance: If you engage in mentoring or tutoring others in finance-related subjects, it showcases your ability to communicate financial concepts effectively and your willingness to help others succeed.

When including hobbies on your resume, it's essential to tailor them to the specific job and company culture. Focus on hobbies that align with the skills and qualities valued in the finance industry, and be prepared to discuss how these hobbies have contributed to your personal and professional development during interviews.

Experience

Carmen Industries | Financial Analyst

2018 -2021

• Analyze current and past financial data

• Look at recent financial performance and identify trends

• Prepare reports on the above information and communicate the insights of these reports to the broader business

• Consult with the management team to develop long-term commercial plans

• Suggest budgets and improvements based on the above information

Ingoude Company | Junior/Investment Analyst

2017-2018

• Looked at financial performance and identified trends

• Explored various investment opportunities.

• Prepared monthly fund analysis reports

• Automated daily financial status reporting tasks using Excel macros

Timmerman Industries | Financial Analyst Intern

2017-2017

• Analyzed financial data

• Observed financial performance and identified trends

Additional Inputs

Mastering Finance Interviews: 5 Common Questions for Fresh Graduates

Embarking on a career in finance can be an exciting journey for fresh graduates. As you step into the interview room, it's crucial to be well-prepared for questions that not only test your technical knowledge but also assess your problem-solving skills and suitability for the role.

Here are five common finance-related questions you might encounter in interviews:

1. Tell Me About Your Academic Background and Relevant Coursework:

This question is an opportunity to showcase your educational foundation in finance. Discuss your degree, major, and any specialized coursework that aligns with the position. Highlight projects or subjects where you applied financial theories to real-world scenarios. Emphasize any academic achievements, such as high grades or notable projects, to demonstrate your commitment to excellence.

2. How Do You Stay Informed About Current Financial News and Trends?

Employers seek candidates who stay abreast of industry developments. Discuss your preferred sources for financial news, whether it's financial publications, reputable websites, or industry-specific journals. Mention any financial certifications you've pursued or are planning to pursue, showcasing your commitment to continuous learning and staying informed.

3. Walk Me Through a Financial Model or Analysis You Have Created:

This question assesses your practical application of financial concepts. Be ready to discuss a project or assignment where you created a financial model, conducted analysis, or made financial projections. Explain the methodology, key assumptions, and how the results influenced decision-making. Focus on your problem-solving approach and attention to detail.

4. How Would You Approach Financial Risk Management in a Company?

This question evaluates your understanding of financial risk and your ability to strategize risk management. Discuss the importance of identifying, assessing, and mitigating financial risks. Provide examples of risk management strategies you've studied or encountered, and emphasize your ability to balance risk and return in decision-making.

5. Why Did You Choose a Career in Finance, and Why This Company?

Employers want to understand your motivation for pursuing a career in finance and why you are interested in their organization. Craft a thoughtful response that connects your passion for finance with the company's values, mission, and industry position. Mention specific aspects of the company, such as its financial innovations, commitment to ethical practices, or industry leadership, to demonstrate your genuine interest.

Final Tips for Success:

Research the Company:

Familiarize yourself with the company's financial standing, recent news, and any financial initiatives. This knowledge will help you tailor your responses to the company's specific context.

Brush Up on Technical Skills:

Be prepared for technical questions related to financial ratios, valuation methods, and accounting principles. Practice solving finance problems to build confidence in your technical abilities.

Showcase Soft Skills:

Alongside technical expertise, emphasize soft skills such as communication, teamwork, and problem-solving. Share examples from your academic or extracurricular experiences that highlight your ability to work effectively in a team and contribute meaningfully to projects.

By preparing for these common finance-related questions, fresh graduates can approach interviews with confidence, demonstrating their academic knowledge, practical skills, and enthusiasm for a rewarding career in finance.