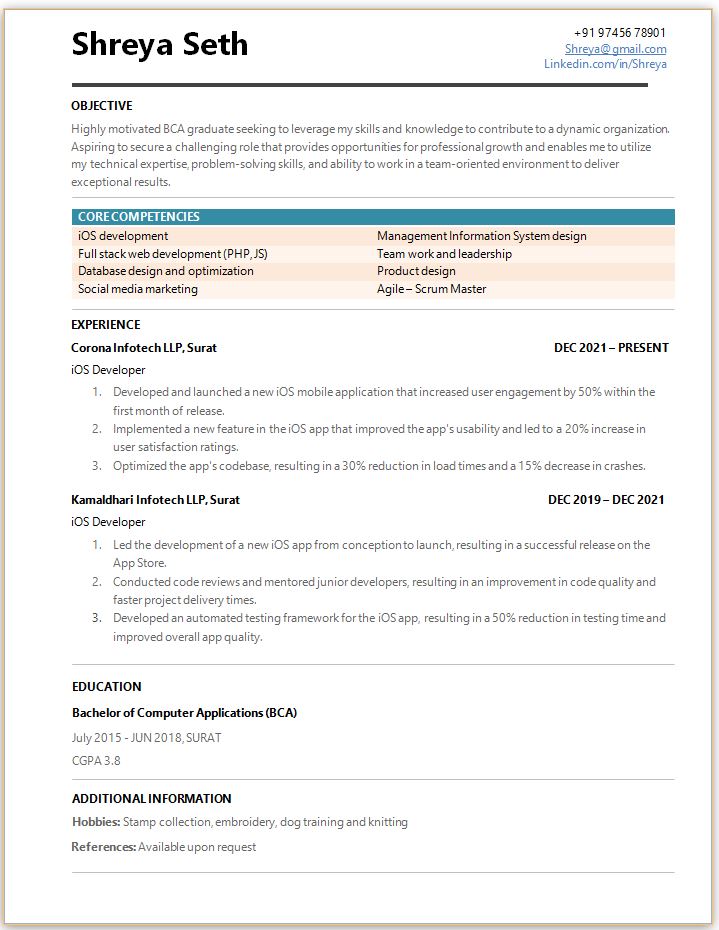

Classic Resume

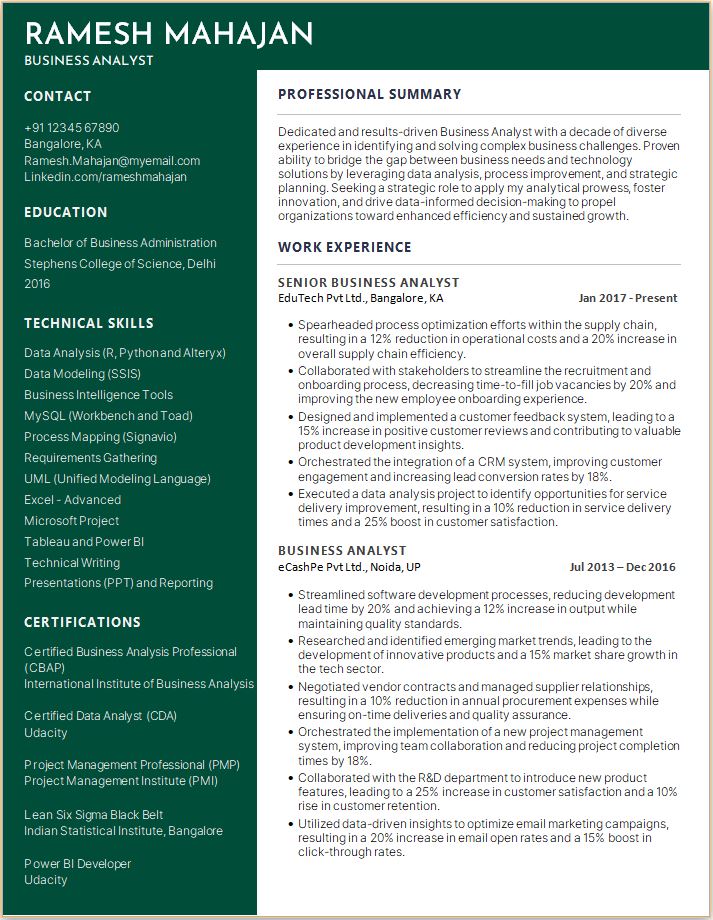

MBA Finance Experienced Resume

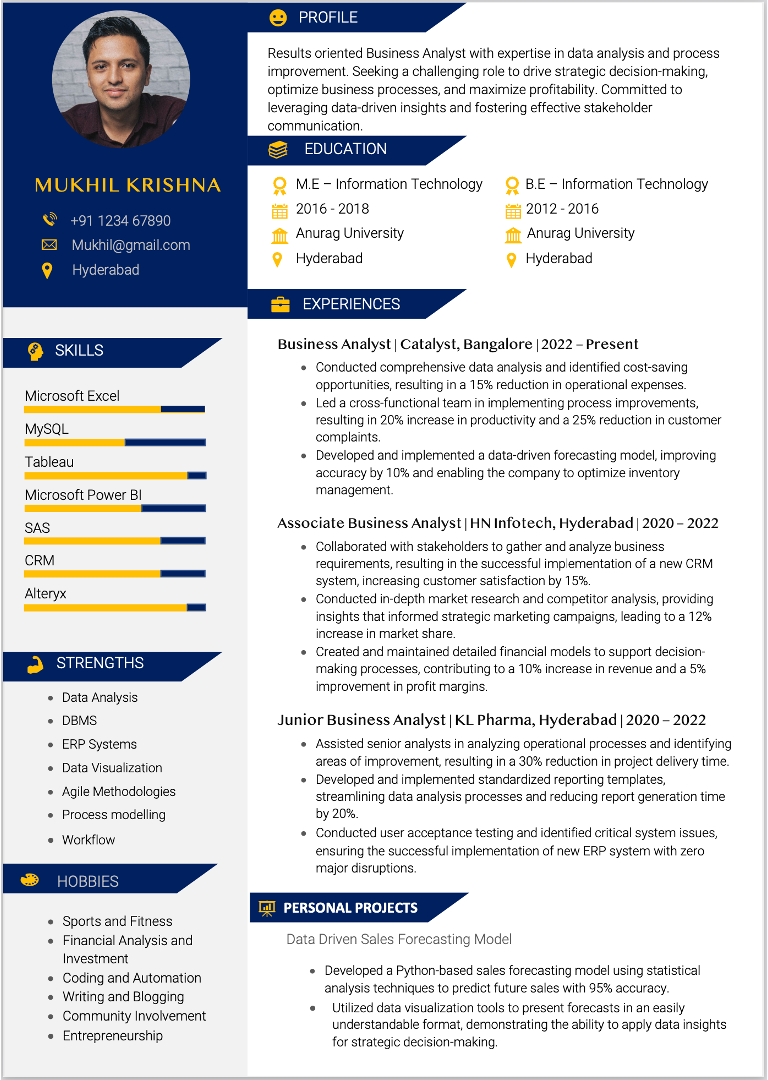

MBA Financial Analyst

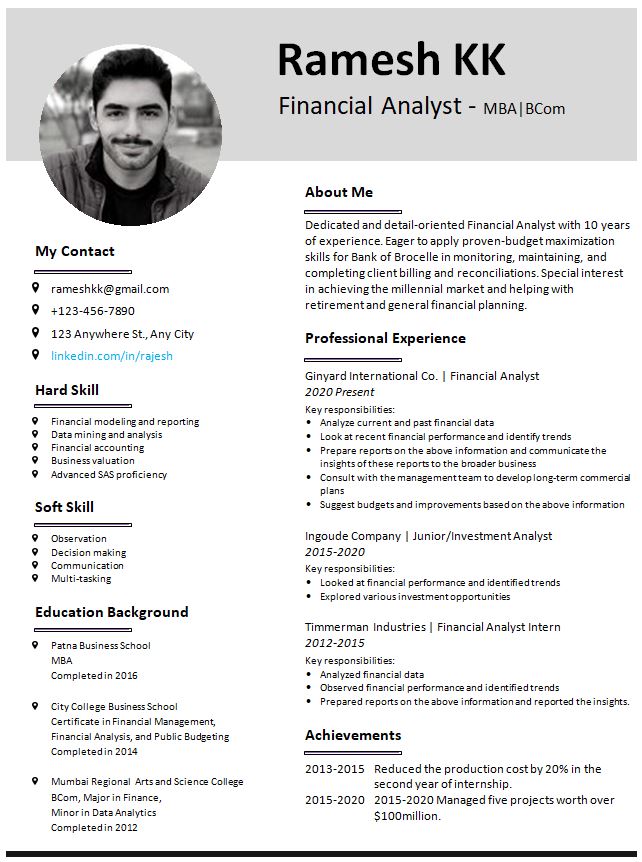

Sigray

Objective

Results-driven MBA graduate with extensive experience in financial analysis, seeking a challenging position as a Senior Financial Analyst. Leveraging advanced financial modeling skills, strategic insights, and strong business acumen to drive financial performance, optimize investment strategies, and provide actionable recommendations for business growth. Committed to delivering accurate and timely financial analysis to support informed decision-making and contribute to the organization's success.

Education

MBA Finance

Skills

Here are the top 5 technical skills critical to Financial Analyst jobs and how you can develop these skills if you haven't had exposure to these subjects in college:

Financial Modeling and Analysis:

Financial modeling involves creating and analyzing complex financial models to evaluate financial performance, forecast future outcomes, and support decision-making. This skill includes proficiency in Microsoft Excel, financial statement analysis, ratio analysis, and forecasting techniques.

How can you develop this skill?

Take online courses or certifications focused on financial modeling and analysis.

Practice building financial models using Excel, incorporating real-world financial data and scenarios.

Analyze financial statements of companies and practice interpreting key financial ratios.

Data Analysis and Interpretation:

Financial analysts need strong data analysis skills to gather, clean, and interpret financial and business data. This involves utilizing data analysis tools, statistical techniques, and data visualization to derive insights and support decision-making.

How can you develop this skill?

Familiarize yourself with data analysis tools like Microsoft Excel, SQL, or data visualization software like Tableau.

Practice analyzing financial data sets, identifying trends, and drawing meaningful conclusions.

Take courses or online tutorials on data analysis and statistics to enhance your understanding of data manipulation and interpretation.

Financial Software and Systems:

Proficiency in financial software and systems is crucial for financial analysts. This includes knowledge of financial management software, enterprise resource planning (ERP) systems, financial databases, and trading platforms.

How can you develop this skill?

Familiarize yourself with popular financial software and systems used in the industry, such as Bloomberg Terminal, Oracle Financials, or SAP.

Seek out training opportunities or certifications offered by software providers or online platforms to gain hands-on experience.

Leverage online resources and tutorials to understand the functionalities and applications of financial software and systems.

Risk Management:

Understanding risk and its impact on financial decision-making is essential for financial analysts. This includes identifying, assessing, and managing financial risks, such as market risk, credit risk, and operational risk.

How can you develop this skill?

Read books or articles on risk management principles and methodologies.

Stay updated on industry regulations and best practices related to risk management.

Look for opportunities to work on projects or assignments related to risk assessment and mitigation, even if it's outside of your current role.

Industry Knowledge:

Having a strong understanding of the industry in which the financial analyst operates is crucial. This includes knowledge of industry-specific trends, regulations, competitors, and market dynamics.

How can you develop this skill?

Stay informed through industry publications, news sources, and industry-specific websites.

Attend industry conferences, webinars, or seminars to gain insights from industry experts.

Network with professionals in the field, join industry-specific groups, or participate in forums to exchange knowledge and stay updated.

To develop these skills without exposure in college, consider taking online courses, attending workshops or boot camps, participating in financial modeling competitions, and seeking out internships or entry-level positions where you can gain hands-on experience. Additionally, self-study through books, online resources, and practical exercises will help you develop and reinforce your technical skills as a financial analyst.

Projects

Here are two project ideas for you to model including your actual projects in the resume. Pay special attention to how the results are quantified.

Project 1:

Investment Portfolio Optimization Project:

Objective:

Optimize an investment portfolio by analyzing asset allocation strategies and evaluating risk-return trade-offs.

Description:

As an MBA finance student, I led a project focused on optimizing an investment portfolio for a client. We analyzed various asset classes, evaluated historical returns and risk metrics, and used portfolio optimization techniques to determine an optimal asset allocation strategy. By rebalancing the portfolio and implementing the recommended allocation, we aimed to enhance returns while managing risk.

Results:

Our optimized portfolio generated an annualized return of 12%, outperforming the benchmark return of 8%. Additionally, we achieved a reduction in portfolio volatility by 15% compared to the initial portfolio. These results showcased the effectiveness of our asset allocation strategy in generating superior risk-adjusted returns.

Interests/Hobbies

You should consider adding hobbies and interests that demonstrate your passion to the domain of finance. Here's a list of hobbies and interests appropriate to include on a Financial Analyst resume, along with the value they can add:

Stock Market Investing:

Interest in stock market investing demonstrates a strong understanding of financial markets, investment strategies, and economic trends. It showcases your ability to analyze financial data and make informed investment decisions, which is valuable for a Financial Analyst role.

Data Analysis and Visualization:

Hobbies related to data analysis and visualization, such as working with data analytics software or creating data visualizations, highlight your analytical skills and attention to detail. It shows that you have a keen interest in leveraging data to gain insights and communicate complex information effectively.

Financial Writing or Blogging:

Engaging in financial writing or blogging exhibits your ability to articulate complex financial concepts in a clear and concise manner. It demonstrates your communication skills and your passion for sharing financial knowledge, which can be beneficial in presenting financial analyses and reports.

Economic Research and Analysis:

Demonstrating an interest in economic research and analysis reflects your ability to stay informed about macroeconomic factors, industry trends, and their impact on financial markets. It highlights your analytical thinking and ability to incorporate economic insights into financial decision-making.

Volunteer Financial Consulting:

Engaging in volunteer work where you provide financial consulting services to nonprofit organizations or individuals showcases your commitment to using your financial skills to make a positive impact. It demonstrates your ability to apply financial expertise to real-world scenarios and your passion for helping others.

Continuing Education in Finance:

Pursuing further education or certifications in finance, such as CFA (Chartered Financial Analyst) or CPA (Certified Public Accountant), shows your commitment to professional development and staying updated with industry best practices. It demonstrates your dedication to expanding your knowledge and skills in the financial field.

Investment Club Membership:

Participating in an investment club highlights your collaborative and teamwork skills. It indicates your ability to work with others in analyzing investment opportunities, making investment decisions, and managing a portfolio as a team, which is valuable in a Financial Analyst role.

Competitive Analysis:

Engaging in activities related to competitive analysis, such as analyzing market trends, monitoring competitors' strategies, or participating in business case competitions, demonstrates your strategic thinking and ability to evaluate market dynamics. It shows your interest in understanding the competitive landscape, which is essential for financial analysis and decision-making.

Including these hobbies and interests on your resume provides a glimpse into your personality, outside interests, and demonstrates your dedication to finance. They can help spark conversation during interviews and differentiate you from other candidates. However, ensure that the hobbies and interests you include are genuine and relevant to your financial expertise and the position you're applying for.

Experience

Project2:

Financial Risk Management Project:

Objective: Develop a comprehensive financial risk management framework for a company, focusing on identifying, assessing, and mitigating financial risks.

Description:

As part of an MBA finance project, our team worked with a company to develop a financial risk management framework. We conducted a thorough analysis of the company's financial risks, including market risk, credit risk, liquidity risk, and operational risk. We identified potential risk exposures, evaluated their impact on financial performance, and designed risk mitigation strategies.

Results:

Implementation of the financial risk management framework resulted in a 25% reduction in market risk exposure, a 20% decrease in credit risk exposure, and a 15% improvement in liquidity risk management. These quantified results demonstrated the effectiveness of our risk management strategies in protecting the company's financial stability and enhancing its resilience to potential risks.

Additional Inputs

It is very important to keep oneself updated of the latest developments in the industry, especially an industry like Finance where Technology has led to massive changes in how the profession has evolved in the last 5 years.

If you are a recent MBA finance graduate, you should consider exploring the following avenues to develop your networking opportunities to increase the chances of information flow and to keep yourself updated of the latest developments in the industry.

Professional Associations and Organizations:

Join relevant professional associations and organizations in the finance industry, such as the CFA Institute, Financial Planning Association, or local finance chapters. Attend their networking events, conferences, and seminars to connect with industry professionals and stay updated on the latest trends.

Alumni Networks:

Leverage your MBA program's alumni network to connect with graduates working in the finance industry. Attend alumni events, join alumni groups on professional networking platforms like LinkedIn, and reach out to alumni for informational interviews or mentorship opportunities.

Industry Conferences and Events:

Attend finance industry conferences, summits, and seminars to gain insights from industry experts, hear about the latest developments, and network with professionals in the field. Participate in panel discussions, workshops, or speaking opportunities to showcase your knowledge and establish your presence in the industry.

Online Professional Networking: Utilize professional networking platforms like LinkedIn to connect with finance professionals, join industry-specific groups, and participate in discussions. Engage with industry influencers, share relevant content, and seek opportunities for virtual networking or informational interviews.

Finance Publications and Newsletters:

Subscribe to finance publications and newsletters, both in print and online formats, to stay updated on industry news, trends, and thought leadership articles. Engage with the content by sharing your perspectives, commenting, or reaching out to authors for further discussions.

Mentorship Programs: Seek out mentorship programs offered by industry organizations or through your alumni network. Mentors can provide guidance, share insights, and introduce you to their professional networks, opening doors to valuable industry connections.

Online Learning Platforms:

Enroll in online courses or programs focused on finance and related topics offered by reputable platforms like Coursera, Udemy, or edX. These platforms often provide opportunities to interact with instructors and fellow learners, fostering networking and knowledge-sharing.

Industry Forums and Discussion Boards: Participate in finance-related forums and discussion boards where professionals gather to share insights, ask questions, and discuss industry topics. Contribute to the discussions, ask thoughtful questions, and connect with individuals who demonstrate expertise in areas of interest.

Remember, building a strong industry network takes time and effort. Be proactive, engage in conversations, and offer value to others. Attend events with a genuine interest in learning and connecting, and nurture relationships by following up and staying in touch. Building a robust network will not only enhance your understanding of the latest developments but also provide valuable career opportunities in the finance industry.

Why this template works

Finance is one of the domains where deep subject matter expertise and frugality are highly appreciated. You can demonstrate your preference for frugality through this simple resume template; jokes apart, a simple resume template like this one helps retain the reviewer's focus on the essential sections like skills, certifications and project experiences.

Consider using this or similar simple resume templates to stand out from the competition.