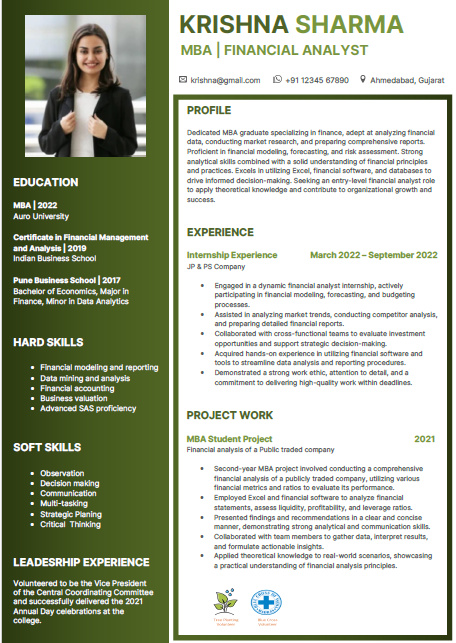

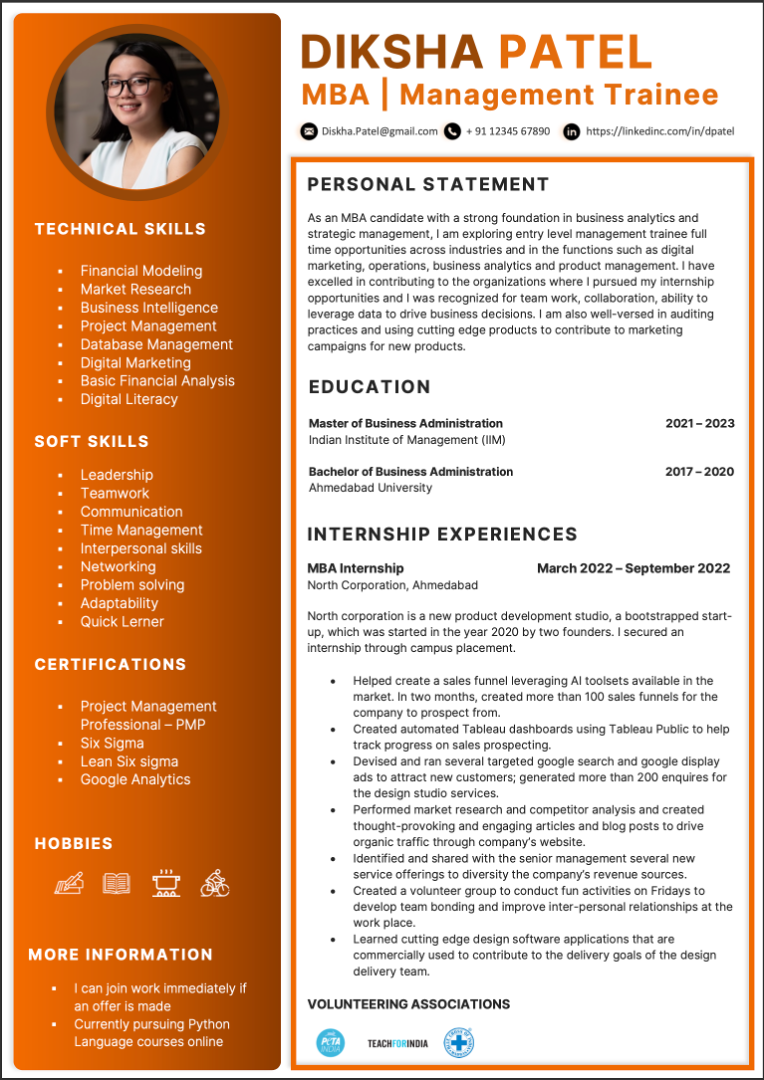

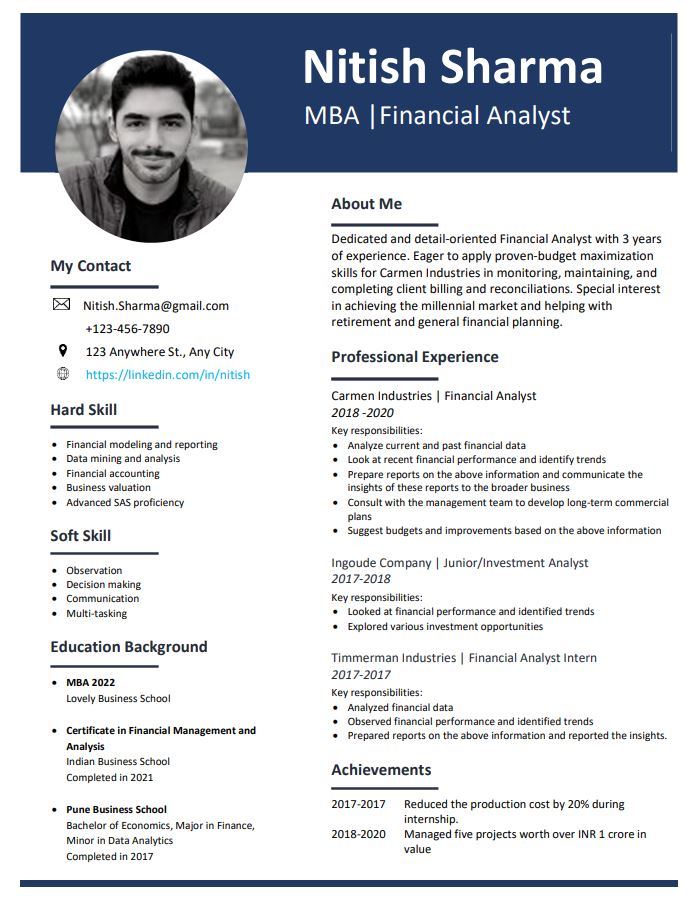

Classic Resume

MBA Finance Resume

MBA Financial Analyst

Bluet

Objective

If you don't find the one on our template appealng,you can consider using this one.

Results-driven MBA Financial Analyst with a strong foundation in finance and a track record of delivering accurate and actionable insights to support strategic decision-making. Seeking a challenging role to leverage advanced financial modeling skills, data analysis expertise, and business acumen to drive financial growth and optimize investment strategies for an organization.

Education

MBA Finance

Skills

Below are some of the most commonly found skills on Financial Analyst resumes.

Financial Analysis:

Expertise in financial statement analysis, ratio analysis, and financial modeling to evaluate company performance, assess risk, and support decision-making.

Data Analysis:

Proficiency in analyzing large datasets, using statistical techniques, and utilizing tools such as Excel, SQL, or Python for data manipulation, visualization, and insights generation.

Investment Analysis: Knowledge of investment evaluation methods, valuation techniques, and portfolio management to assess investment opportunities, conduct risk assessments, and optimize investment strategies.

Financial Forecasting:

Ability to develop accurate financial forecasts, perform scenario analysis, and utilize forecasting models to support budgeting, planning, and business strategy formulation.

Budgeting and Cost Analysis:

Experience in budget creation, variance analysis, cost control, and identifying areas for cost optimization to enhance profitability and operational efficiency.

Risk Management:

Understanding of risk assessment methodologies, development of risk mitigation strategies, and implementation of risk management frameworks to minimize potential financial risks.

Business Acumen:

A strong understanding of business operations, industry dynamics, market trends, and competitive landscape to provide strategic financial recommendations aligned with organizational goals.

Financial Reporting:

Proficiency in preparing financial reports, management dashboards, and presentations to communicate financial analysis findings and key performance indicators (KPIs) to stakeholders.

Corporate Finance:

Knowledge of corporate finance principles, including capital structure, capital budgeting, cash flow analysis, and mergers and acquisitions (M&A) evaluation.

Communication and Presentation:

Excellent verbal and written communication skills to effectively convey complex financial concepts, present findings to stakeholders, and collaborate with cross-functional teams.

Problem-Solving:

Strong analytical and problem-solving abilities to identify financial issues, develop innovative solutions, and make informed recommendations for strategic decision-making.

Teamwork and Collaboration:

Ability to work collaboratively with diverse teams, build relationships, and effectively contribute to group projects and initiatives.

Projects

Here are two sample student project ideas that fresh graduates can consider including on their resume for Financial Analyst jobs.

Investment Portfolio Optimization Project:

Objective:

Develop an optimized investment portfolio by applying modern portfolio theory principles and diversification strategies.

Description:

As part of a finance course project, I constructed and optimized an investment portfolio consisting of stocks, bonds, and other financial instruments. Using historical data, I performed rigorous analysis, including risk assessment, return calculations, and correlation analysis. By applying diversification techniques and portfolio rebalancing, I aimed to maximize returns while minimizing risks.

Results:

Achieved a portfolio return of 12% over a one-year period, outperforming the benchmark index return of 8%. The portfolio's risk (standard deviation) was reduced by 15% compared to the benchmark, demonstrating the effectiveness of diversification strategies.

Interests/Hobbies

Here are some hobbies and interests for you to consider including on your Financial Analyst resume.

Stock Market Investing:

Showcasing an interest in stock market investing demonstrates a passion for financial markets, staying updated on market trends, and actively managing personal investment portfolios.

Financial Research:

Demonstrating an interest in conducting financial research, such as analyzing investment opportunities, tracking economic indicators, or following industry news, highlights a commitment to continuous learning and staying informed about financial markets.

Data Analysis and Visualization:

Mentioning an interest in data analysis and visualization tools, such as Excel, Tableau, or Power BI, suggests a proficiency in leveraging data to derive insights and communicate complex financial information effectively.

Volunteering with Financial Literacy Programs:

Involvement in financial literacy programs or volunteering to teach financial literacy workshops showcases a commitment to educating others about personal finance, budgeting, and investing, which aligns with the financial analyst role.

Professional Networking:

Participation in industry events, networking groups, or finance-related professional associations demonstrates an active engagement in the finance community, building connections, and staying up-to-date with industry trends.

Business Book Club:

Membership in a business book club or an interest in reading finance and investment-related books exhibits a dedication to continuous learning and professional development in the financial domain.

Economic and Financial News Analysis:

A keen interest in analyzing economic and financial news, following reputable sources, and staying informed about market developments reflects a proactive approach to staying updated on relevant industry information.

Personal Finance Management:

Demonstrating an interest in personal finance management and implementing effective budgeting, savings, and investment strategies suggests a strong understanding of financial principles and responsible financial practices.

Leadership Development:

Engaging in leadership development activities, such as attending leadership workshops or volunteering for leadership roles in organizations, showcases a commitment to personal growth and acquiring skills beyond finance.

Sports Analytics:

An interest in sports analytics, such as applying statistical analysis to sports data or using data-driven insights for sports-related decision-making, demonstrates a unique blend of analytical skills and passion for sports.

Experience

Financial Forecasting and Budgeting Project:

Objective:

Develop a comprehensive financial forecast and budgeting model for a startup company.

Description:

In collaboration with a team, I created a financial forecast and budgeting model for a fictitious startup company. The project involved analyzing market trends, conducting industry research, and developing revenue and expense projections for a three-year period. We utilized financial ratios, growth rates, and other industry benchmarks to develop realistic financial projections.

Results:

Developed a financial forecast that accurately predicted the company's revenue growth, with an average variance of less than 5% over the three-year period. The budgeting model effectively tracked expenses and enabled proactive cost management, resulting in a 10% reduction in operational expenses and an improvement in profit margins by 8% compared to the initial projections.

Additional Inputs

If you are a recent MBA finance graduate, there are a lot of resources to help you develop your financial analyst skills. Here are some valuable resources to consider:

Online Courses and Learning Platforms:

Platforms like Coursera, Udemy, and edX offer a wide range of online courses specifically designed to enhance financial analysis skills. Look for courses on financial modeling, financial statement analysis, investment analysis, and data analysis. Popular courses include "Financial Modeling and Valuation" by Wharton, "Financial Analysis and Decision Making" by University of Michigan, and "Investment and Portfolio Management" by Rice University.

Professional Certifications:

Pursuing professional certifications in financial analysis can add credibility to your resume. Consider certifications such as Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), or Certified Financial Modeling & Valuation Analyst (FMVA) offered by recognized institutions. These certifications provide comprehensive knowledge and are highly regarded in the industry.

Financial Publications and Journals:

Regularly reading financial publications, journals, and websites can help you stay updated with industry trends, economic developments, and best practices in financial analysis. Explore resources like The Wall Street Journal, Financial Times, Bloomberg, Investopedia, and Harvard Business Review.

Webinars and Online Workshops:

Attend webinars and online workshops conducted by industry professionals and experts. These events cover various topics related to financial analysis, such as advanced Excel skills, financial modeling techniques, or industry-specific analysis. Keep an eye on platforms like LinkedIn Learning, Financial Modeling Institute, or specialized financial training providers.

Networking and Professional Associations:

Engage with finance professionals, join finance-related networking groups, and become a member of professional associations such as the Financial Management Association (FMA), CFA Institute, or Financial Planning Association (FPA). These communities provide opportunities to connect with industry experts, attend conferences, and gain insights into the latest financial analysis practices.

Case Studies and Financial Modeling Projects:

Solve case studies and practice financial modeling exercises to hone your skills. Websites like Wall Street Oasis and eFinancialModels offer resources and examples for financial modeling projects. Participate in finance competitions or challenge yourself with real-world scenarios to gain practical experience.

Mentorship and Internships:

Seek mentorship from experienced financial analysts or consider internships with reputable financial firms. Working alongside professionals in the field provides practical exposure and insights into financial analysis methodologies and processes.

Excel and Data Analysis Tools:

Enhance your proficiency in Microsoft Excel, including advanced functions, pivot tables, and data analysis techniques. Additionally, familiarize yourself with data analysis tools such as Python, R, or SQL, as these skills are becoming increasingly valuable in financial analysis.

Why this template works

We know this template works because this template contents are modelled after a successful resume that landed an IIM Indore Executive MBA candidate a job in a leading financial services company.

This template works because this template has all the essential components of a successful Financial Analyst resume.