Modern Resume

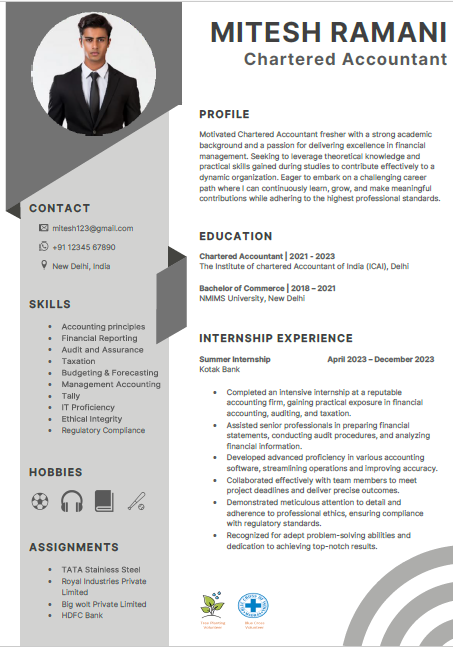

CA Fresher Sample Resume

Chartered Accountant

CA Fresher

Objective

Motivated Chartered Accountant fresher with a strong academic background and a passion for delivering excellence in financial management. Seeking to leverage theoretical knowledge and practical skills gained during studies to contribute effectively to a dynamic organization. Eager to embark on a challenging career path where I can continuously learn, grow, and make meaningful contributions while adhering to the highest professional standards.

Education

Chartered Accountant | 2021 - 2023

The Institute of chartered Accountant of India (ICAI), Delhi

Bachelor of Commerce | 2018 – 2021

NMIMS University, New Delhi

Skills

• Accounting principles • Financial Reporting • Audit and Assurance • Taxation • Budgeting & Forecasting • Management Accounting • Tally • IT Proficiency • Ethical Integrity • Regulatory Compliance

Projects

• TATA Stainless Steel

• Royal Industries Private Limited

• Big wolt Private Limited

• HDFC Bank

Interests/Hobbies

Playing games, Music, Reading Books

Experience

INTERNSHIP EXPERIENCE

Summer Internship April 2023 – December 2023

Kotak Bank

• Completed an intensive internship at a reputable accounting firm, gaining practical exposure in financial accounting, auditing, and taxation.

• Assisted senior professionals in preparing financial statements, conducting audit procedures, and analyzing financial information.

• Developed advanced proficiency in various accounting software, streamlining operations and improving accuracy.

• Collaborated effectively with team members to meet project deadlines and deliver precise outcomes.

• Demonstrated meticulous attention to detail and adherence to professional ethics, ensuring compliance with regulatory standards.

• Recognized for adept problem-solving abilities and dedication to achieving top-notch results.

Additional Inputs

Here's a sample list of assignments that a CA fresher might include in their resume:

1. Financial Accounting:

- Prepared and maintained general ledger accounts.

- Assisted in the preparation of financial statements including balance sheets, income statements, and cash flow statements.

- Conducted reconciliations of bank statements, accounts receivable, and accounts payable.

2. Audit Support:

- Assisted senior auditors in planning and executing audit procedures.

- Conducted substantive testing and documentation of audit findings.

- Contributed to the preparation of audit reports and recommendations for clients.

3. Taxation:

- Assisted in the preparation and filing of tax returns for individuals and businesses.

- Conducted tax research and analysis to support tax planning strategies.

- Assisted in responding to tax notices and inquiries from tax authorities.

4. Accounting Software Proficiency:

- Demonstrated proficiency in accounting software such as Tally, QuickBooks, or Xero.

- Utilized software tools to record transactions, generate reports, and reconcile accounts.

5. Team Collaboration:

- Worked collaboratively with team members to achieve project goals and deadlines.

- Participated in team meetings and contributed ideas for process improvements.

- Provided support and assistance to colleagues as needed.

6. Regulatory Compliance:

- Ensured compliance with relevant accounting standards, tax laws, and regulatory requirements.

- Maintained up-to-date knowledge of changes in accounting and tax regulations.

- Implemented internal controls to safeguard financial data and ensure accuracy.

7. Problem-Solving:

- Demonstrated strong problem-solving skills in resolving accounting discrepancies and issues.

- Analyzed financial data to identify trends, anomalies, and opportunities for improvement.

- Proposed solutions and recommendations to address accounting challenges effectively.

8. Attention to Detail:

- Exhibited meticulous attention to detail in performing accounting tasks and reconciliations.

- Reviewed financial documents and reports for accuracy and completeness.

- Conducted thorough reviews of work to identify and correct errors promptly.

9. Professionalism:

- Upheld professional ethics and integrity in all assignments and interactions.

- Communicated effectively with clients, colleagues, and superiors in a professional manner.

- Maintained confidentiality of sensitive financial information and client data.

10. Continuous Learning:

- Actively pursued continuing professional education to enhance skills and knowledge.

- Participated in training sessions, seminars, and workshops to stay abreast of industry trends.

- Demonstrated a commitment to lifelong learning and professional development.