Modern Resume

CA Fresher Sample Resume

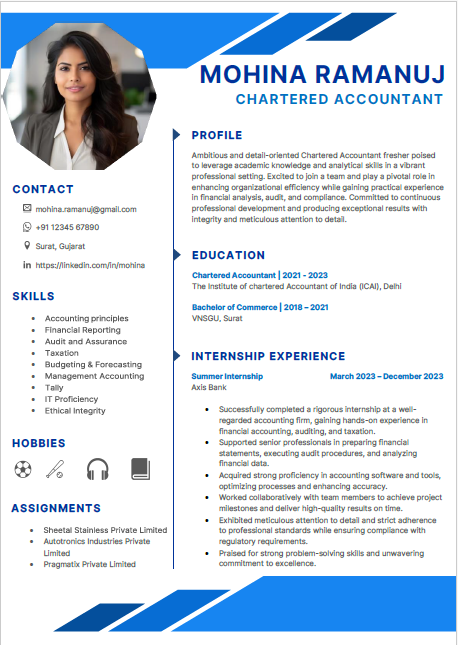

Chartered Accountant

Chartered accountant

Objective

Ambitious and detail-oriented Chartered Accountant fresher poised to leverage academic knowledge and analytical skills in a vibrant professional setting. Excited to join a team and play a pivotal role in enhancing organizational efficiency while gaining practical experience in financial analysis, audit, and compliance. Committed to continuous professional development and producing exceptional results with integrity and meticulous attention to detail.

Education

Chartered Accountant | 2021 - 2023

The Institute of chartered Accountant of India (ICAI), Delhi

Bachelor of Commerce | 2018 – 2021

VNSGU, Surat

Skills

• Accounting principles • Financial Reporting • Audit and Assurance • Taxation • Budgeting & Forecasting • Management Accounting • Tally • IT Proficiency • Ethical Integrity

Interests/Hobbies

Playing games, Music, Reading Books

Experience

INTERNSHIP EXPERIENCE

Summer Internship March 2023 – December 2023

Axis Bank

• Successfully completed a rigorous internship at a well-regarded accounting firm, gaining hands-on experience in financial accounting, auditing, and taxation.

• Supported senior professionals in preparing financial statements, executing audit procedures, and analyzing financial data.

• Acquired strong proficiency in accounting software and tools, optimizing processes and enhancing accuracy.

• Worked collaboratively with team members to achieve project milestones and deliver high-quality results on time.

• Exhibited meticulous attention to detail and strict adherence to professional standards while ensuring compliance with regulatory requirements.

• Praised for strong problem-solving skills and unwavering commitment to excellence.

Additional Inputs

For Chartered Accountants (CAs) looking to enhance their skills and knowledge, several courses can be beneficial in expanding their expertise and career opportunities. Here are some useful courses for CAs:

1. Financial Modeling and Analysis:

Learn how to create advanced financial models for business valuation, forecasting, and strategic planning.

2. Advanced Taxation:

Stay updated with the latest tax regulations and laws to provide better services and advice to clients.

3. Forensic Accounting and Fraud Examination:

Gain specialized skills in detecting and preventing financial fraud and misconduct.

4. Business Valuation:

Understand the principles and techniques of business valuation for mergers, acquisitions, and other financial transactions.

5. Risk Management and Compliance:

Learn how to assess and mitigate risks in business operations and ensure compliance with regulatory requirements.

6. International Financial Reporting Standards (IFRS):

Stay updated with global accounting standards to work with international clients or in multinational companies.

7. Data Analytics and Business Intelligence:

Learn how to use data analytics tools to gather insights from financial data and support business decision-making.

8. Corporate Finance and Mergers & Acquisitions:

Understand the complexities of corporate finance, including capital structure, funding, and M&A transactions.

9. Financial Planning and Wealth Management:

Develop skills in personal finance, estate planning, and investment strategies for high-net-worth individuals.

10. Leadership and Management Courses:

Enhance soft skills such as communication, team leadership, and strategic decision-making for higher-level positions.

11. Technology and Automation in Accounting:

Learn about the latest accounting software and automation tools to improve efficiency in financial processes.

12. Ethics and Professional Standards:

Stay informed about ethical considerations and professional standards in accounting and finance.

These courses can help CAs stay competitive in the industry, expand their service offerings, and take on more specialized roles in their careers.

Why this template works

This is very simple and professional template. it is easy to edit according to your skills and projects.